Plan the year. Fund the future.

Build your annual budget from real spending data, plan capital projects years ahead, fund reserves with confidence, and let your board vote to approve — all without a spreadsheet.

From real spending to board-approved budget

Three steps. No spreadsheets. No guesswork.

Your budget starts with real data

Nestingbird pulls from categorized bank transactions to draft a budget grounded in actual spending.

Plan reserves and capital projects

Add capital projects with target years, estimated costs, and inflation adjustments. Reserve contributions calculate automatically.

Board votes to approve

Share the draft, call a vote, and approve with a two-thirds majority. Monthly assessments calculate automatically.

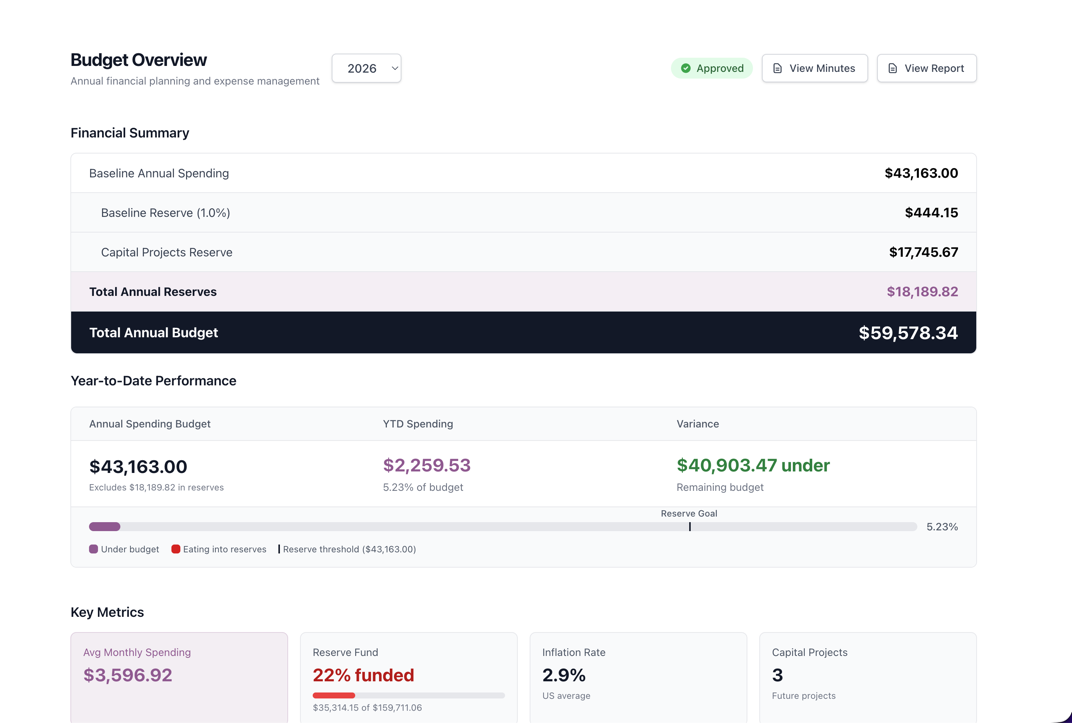

Budget planning that thinks ahead

Operating expenses, reserve funding, and capital projects — all in one place.

Capital Project Forecasting

Plan major repairs years in advance with target dates, priority levels, and inflation-adjusted cost estimates that feed directly into your reserve allocation.

Reserve Funding Calculator

Know exactly how much to set aside each year. Nestingbird calculates the annual reserve contribution needed to cover every planned capital project on schedule.

Inflation Adjustments

Set an inflation rate and watch future costs adjust automatically. Your five-year roof estimate stays accurate without manual recalculation.

Category-Level Budgeting

Break down the budget by category and payee. Owners see exactly what's allocated for landscaping, utilities, insurance — and who gets paid.

Board Approval Workflow

Call a vote, track yays and nays, and enforce two-thirds majority automatically. Budget approval is formal, documented, and built in.

Shareable Budget Reports

Generate a PDF or share a live link. Owners see the full budget breakdown — operating costs, reserve allocations, and per-unit assessments.

Stop budgeting in spreadsheets.

Plan your year, fund your reserves, and get board approval — all in one place. No credit card required.

Get Started Free →